In keeping up with trends over the last couple of months, here’s a look at April from Freestar’s side and a few industry resources. Likely not a newsflash to anyone – April was particularly soft in average CPM and spend – but we did see some encouraging signs near the end of the month. From many of our conversations with demand partners, and more generally with vendors in the space, about the best you could hope for in April was to stay consistent on CPMs. “Flat” is the norm for now, and based on our holistic data, that’s effectively where things ended up. CPMs stayed steady with a +/- of 1 to 2 cents (on the whole) throughout the first half of the month and started creeping up towards the second half of the month. In totality, April 2020 was a very tough month for all publishers.

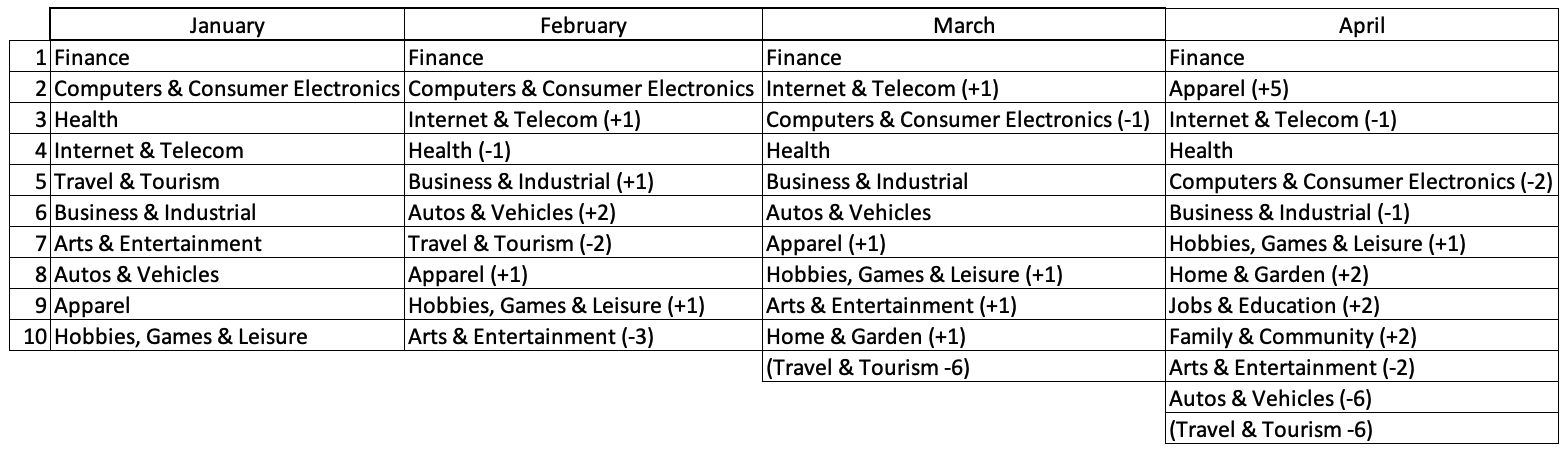

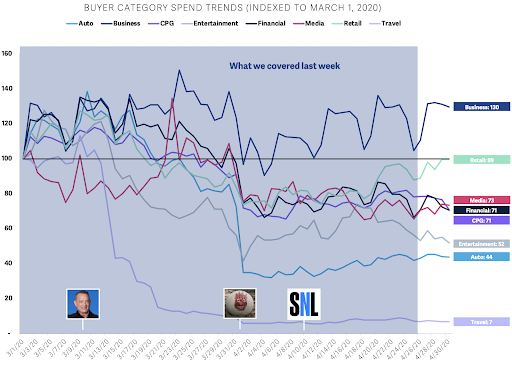

We’ve been looking at our AdX advertiser vertical trends each month. Below is the snapshot through April. Auto took a big hit, and Travel continued to drop down and almost out of our top 25.

Looking at data from one of our demand partners, Index Exchange, you can see some positive movement in their spend trends. This data is from their most recent May 5th newsletter:

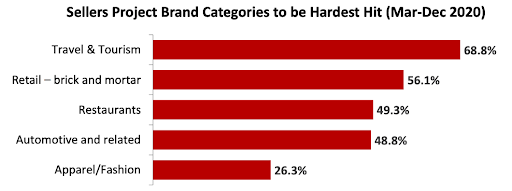

The IAB recently conducted surveys from the publisher and advertiser sides of our industry, that provide some interesting information. The first survey was administered for a publisher / sell-side leadership group. Not surprising, the common thread here is that the group polled sees the advertising categories that will be hit the hardest are those that require consumption outside of the home. Our AdX data for April lines up with the expectations for Travel and Auto, but surprisingly Apparel had a noticeable surge for us – contrary to the sentiments of these publisher leaders.

The question asked: Please select the top five categories you project will be the hardest hit / have the greatest negative impact against your original 2020 plan?

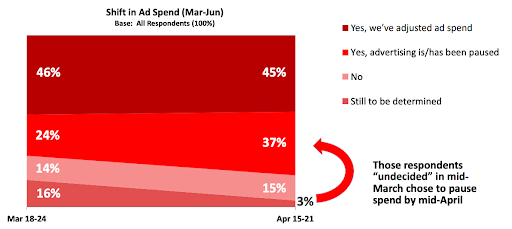

The second IAB survey is from an advertiser / buy-side leadership group. The slide I found most interesting shows how buying patterns have been shifting from the second half of March through April and beyond.

The first question asked: Are you making any short-term (Mar-Jun) advertising spend changes as a result of Coronavirus?

The second question asked: Are you making any Q2 (Apr-Jun) changes to advertising spend as a result of Coronavirus vs. planned investment you had originally planned?

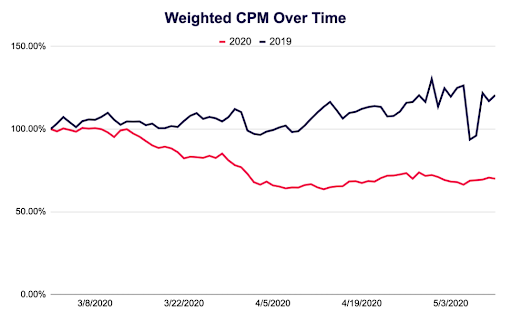

We have an interesting perspective from one of our ad quality vendors, Confiant. In their May 4th newsletter, they shared a view of weighted CPMs over time. Confiant analyzed 15 billion impressions from March 1st to May 4th; the dips they are showcasing align with what we’re seeing and general market trends as well.

The overall takeaways from the Confiant data:

- CPMs have dropped ~ 30% since early March.

- Mid-April appears to be “rock bottom” as CPMs started rebounding in the second half of the month.

- Year over Year: May 2019 CPMs increased by ~16% versus March 2019. For the same time frame this year, the Confiant data shows a drop of ~ 30% compared to March 2020 CPMs.

- CPMs trended up ~ 5% from that “rock bottom” point.

At Freestar, we will continue to monitor performance, provide resources, and look for new revenue opportunities to continue to diversify our offering. Based on the trends we’ve seen through the second half of April, we expect to continue to make gains through the remainder of Q2. There is more optimism on how the second half of the year finishes and as the USA starts opening business back up, we expect that advertiser sentiments will be shifting more positively as well.